An LLC operating agreement is a legal document that summarizes a limited liability company’s function, structure, and rules. It acts as a roadmap for the company, providing its members with a clear sense of direction for the near to long term on several key topics.

By reading a business’ operating agreement, one learns who the members are (and their ownership percentages), how the business will fund itself, its future plans, how profits and losses will be handled, each member’s voting rights, and the plans in place for emergencies and other unexpected events.

Required in: California, Delaware, Maine, Missouri, Nebraska, and New York.

Regardless of a state’s requirements, creating an operating agreement at the onset of an LLC is highly recommended due to the organizational and structural benefits they provide.

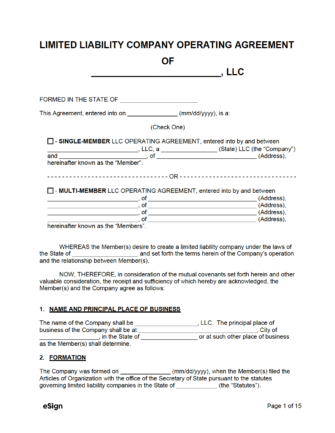

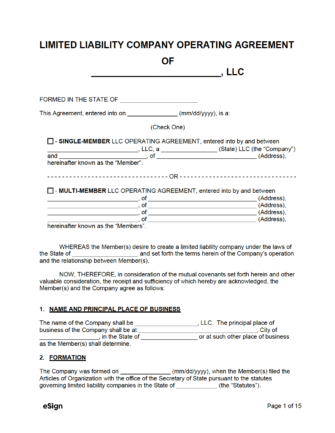

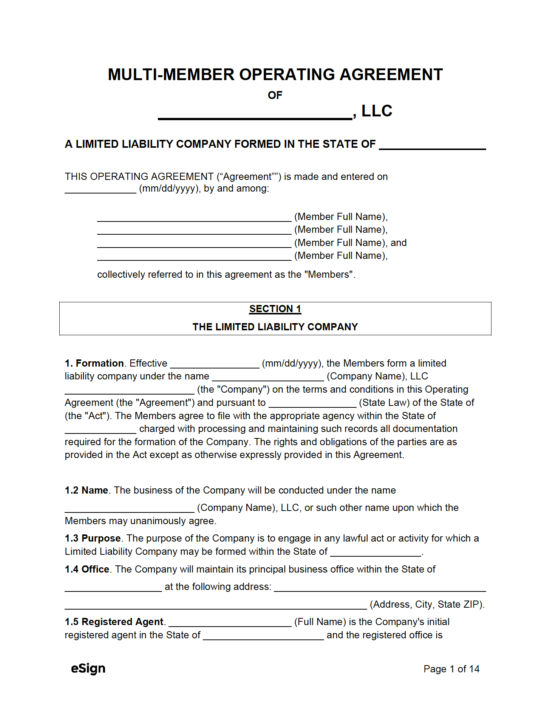

Multi-Member LLC – A business contract for limited liability entities with two (2+) or more owners.

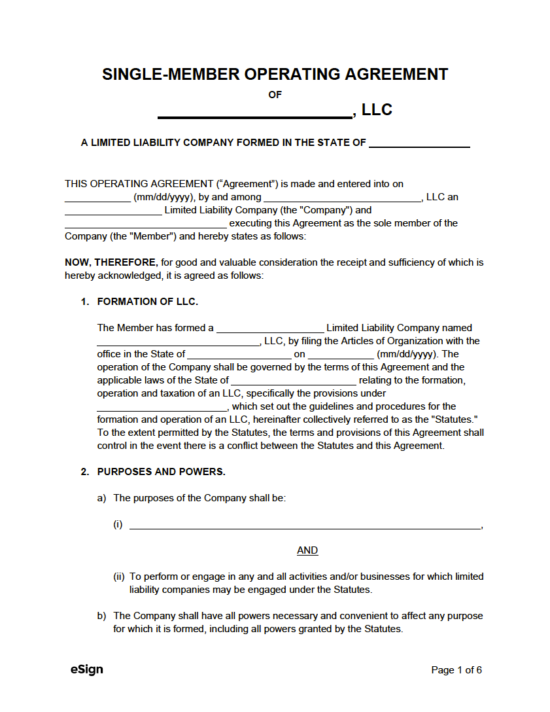

Single-Member LLC – For entities that will have only one (1) owner.

Simple Version – A barebones form that can be used on its own or as a starting point for those looking to draft their own contract. Works for both single and multi-member LLCs.

An LLC operating agreement establishes the fundamental guidelines and operational procedures of a newly formed company. It allows the business’ founder(s) to outline the entity’s short- and long-term plans. A straightforward game plan makes navigating the inevitable hurdles that startups face significantly easier. It’s important to know that the agreement is not set in stone but can (and should) be altered to match the company’s visions and goals as it grows.

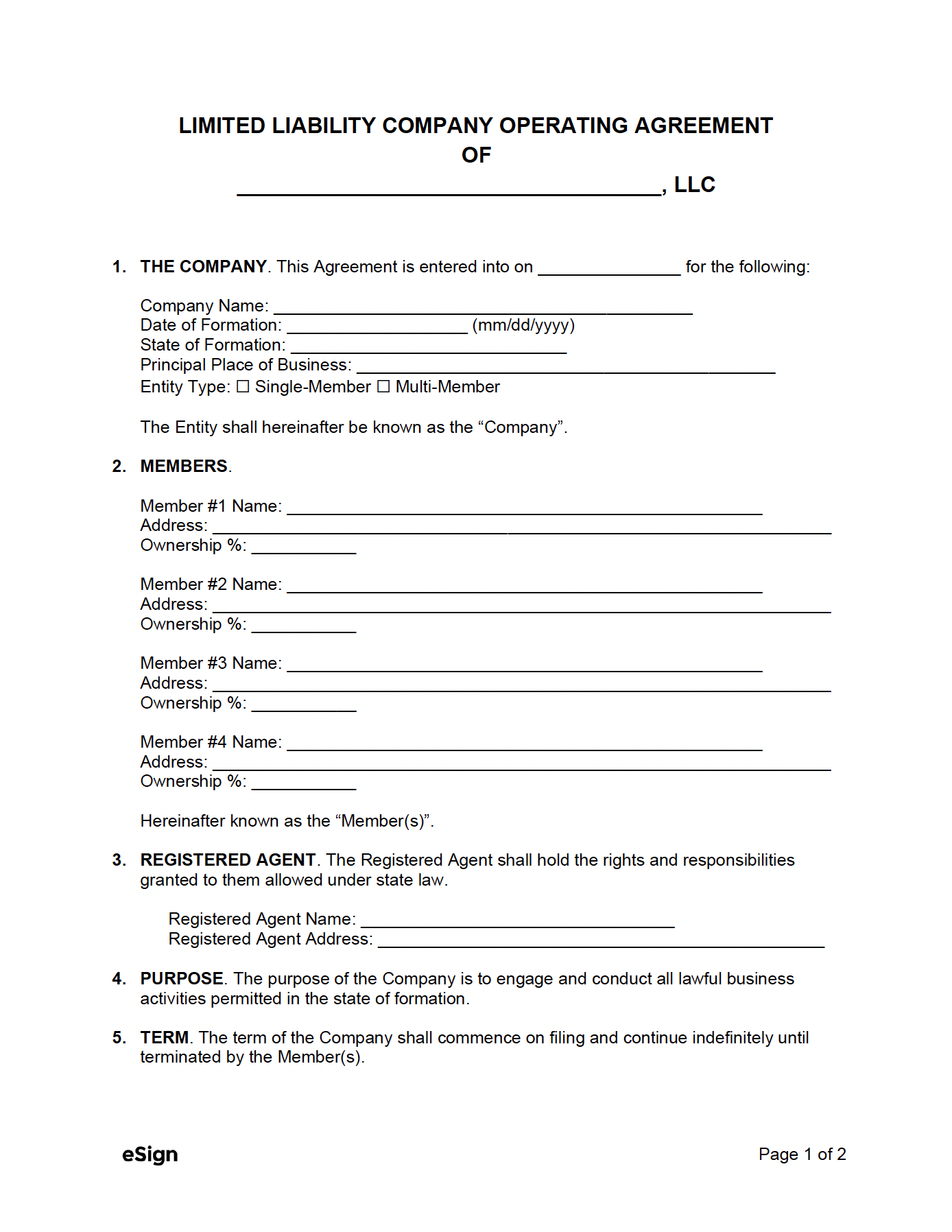

1. THE COMPANY. This Agreement is entered into on [MM/DD/YYYY] for the following:

Company Name: [COMPANY NAME]

Date of Formation: [MM/DD/YYYY]

State of Formation: [STATE]

Principal Place of Business: [ADDRESS]

Entity Type: ☐ Single-Member ☐ Multi-Member

The Entity shall hereinafter be known as the “Company”.

2. MEMBERS.

Member #1 Name: [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #2 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #3 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Member #4 Name (if applicable): [MEMBER NAME]

Address: [MEMBER ADDRESS]

Ownership %: [%]

Hereinafter known as the “Member(s)”.

3. REGISTERED AGENT. The Registered Agent shall hold the rights and responsibilities granted to them allowed under state law.

Registered Agent Name: [REGISTERED AGENT NAME]

Registered Agent Address: [REGISTERED AGENT ADDRESS]

4. PURPOSE. The purpose of the Company is to engage and conduct all lawful business activities permitted in the state of formation.

5. TERM. The term of the Company shall commence on filing and continue indefinitely until terminated by the Member(s).

6. MEMBER CAPITAL CONTRIBUTIONS. The Member(s) may contribute their own assets at any time to benefit the Company. All capital contributions shall be listed in an attached addendum and signed by all Member(s).

7. DISTRIBUTIONS. After meeting the financial obligations of the Company, the Company shall distribute cash and other assets to the Member(s) in a manner determined by the Member(s).

8. BOOKS AND RECORDS. The Company shall maintain complete and accurate books and records of the Company’s business and affairs as required by the State of Formation.

9. MANAGEMENT. The day-to-day management of the Company shall be determined by the Member(s). The Member(s) may elect a Manager to oversee day-to-day operations.

10. ANNUAL MEETINGS. The Member(s) agree to meet on an annual basis. The Member(s) shall be notified of the date, time, and the location of the meeting within thirty (30) days it is to take place.

11. NOTICES. All notices, demands, requests, or other communications relating to this Agreement must be in writing and delivered via certified mail.

12. ARBITRATION. All claims and disputes arising under this Agreement are to be settled by binding arbitration in the State of Formation, or another location agreed upon by all Member(s).

13. AMENDMENTS. This Agreement may not be altered, amended, or changed in any respect unless agreed-upon by a majority of the Member(s). Any changes must be made in writing and signed by all Members.

14. INDEMNIFICATION. The Member(s) shall not be liable, responsible, or accountable, in damages or otherwise, to the Company or any other person acting for on behalf of the Company.

The Member(s) hereto have executed and delivered this Agreement as of the date first above written.

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Member Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [MEMBER NAME]

Each state has its own requirements for naming an LLC. However, the majority have the following two (2) requirements:

Certain names, such as those that end with “bank,” “trust,” “credit union,” “insurance,” etc., commonly require additional fees, paperwork, or special approval. Members should use their state’s Secretary of State entity database to cross-reference possible LLC name options.

A registered agent is a person that is responsible for receiving important documents regarding the entity. If someone were to sue the LLC, the registered agent would be the person served. They are also the designated receiver for official government documents and other important communications. The registered agent must be a resident of the state where the business operates.

To make the LLC official, it must be filed with the Secretary of State. Beware that your state may call the Articles of Incorporation by a different name. This can often be done online (click on one of the states above to learn how to file). The information required by most states includes the following:

There is a vast number of ways to create an LLC Operating Agreement, including the following options:

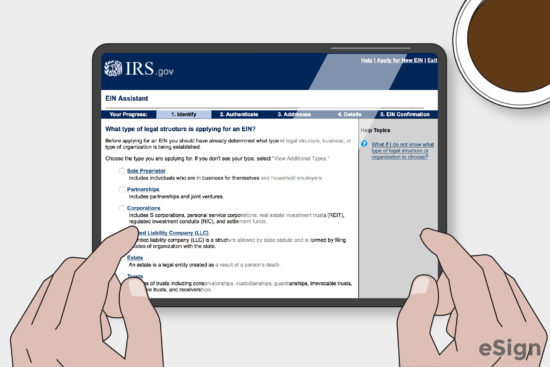

An EIN (Employer Identification Number) is assigned by the IRS to business entities for tax administration purposes. A company can only have one (1) EIN. It is not a requirement for all businesses, but it is a requirement if the LLC will be opening a business bank account, hiring employees, and filing certain tax returns. A complete list can be found by going to the IRS article Do You Need an EIN?

The annual report is also known as the “Periodic Report,” “Annual Statement,” and “Statement of Information,” among other titles.

The state in which the LLC was filed will require that the LLC file an annual report on an annual basis (most common), although sometimes it could be bi-annually, or per decade, among other timeframes. The report ensures the LLC remains in compliance with state statutes and provides the state with up-to-date information on the company, including its members, registered agent, addresses, and more. If the annual report isn’t filed in a timely manner, the state may charge a fee. If too much time passes, the company will be dissolved by the state. Many states allow the annual report to be filed online. A fee may be required alongside the report, with some states charging a fee as high as $500.

While an operating agreement does not require a specific layout in order to be legally binding, there is a generally accepted format for structuring the contract, as outlined below. Additional sections can be added at the end or in between sections if deemed necessary by the company’s members.

This establishes the basic details of the company, as well as how it came into existence. The date of creation, as well as the state in which it was founded, are required. Furthermore, the registered agent’s name and place of business should also be included.

If the entity is a multi-member LLC, the members and duties section will include the full names of each member as well as their personal addresses. While optional, each member’s duties can be established to ensure everyone clearly understands their roles within the company. This is commonly done if the LLC is member-managed instead of manager-managed. A manager-managed company can involve members being passive investors instead of having actual day-to-day responsibilities.

Depending on the state’s requirements, the purpose statement can be specific or general. A general purpose statement is a standard paragraph that states the company will be organized for a lawful purpose and will comply with all laws of the state in which it operates. A specific purpose statement is commonly a one (1) to two (2) paragraph description of the primary purpose of the company. This should be a general outline of what services or products the company intends to provide for its clients and customers.

A capital contribution is an amount ($) given by a member to fund the company during the start-up stage. In return for providing money to the company, members can be given additional ownership in the LLC, often called “units” or “credits.” The term “share” is typically reserved for formal corporations. Each member’s ownership percentage should be stated near the beginning of the document. The percentage of all members needs to add up to 100%.

For multi-member LLCs, the operating agreement should include the process for voting on major decisions, who has the right to cast votes (and why), what majority is required for passing a vote, and what issues/decisions qualify for voting to take place.

A distribution is a share of profit that is delivered to a member at the end of the tax year. It is typically equivalent to their ownership percentage of the business. The agreement should state when and how distributions are made. The way an LLC distributes its profits is dependent on the way it opted to be taxed. For single-member LLCs, the owner can choose to be taxed as a sole proprietor or as a corporation. Multi-member LLCs have the option of being taxed as a partnership or a corporation.

Adding a clause dedicated to dispute resolution provides the members with an agreed-upon process for resolving arguments pertaining to the company. With arbitration, the members agree to have a pre-determined third party listen to both sides of the argument, and make a binding decision on the matter. The members are legally required to accept the decision made by the arbitrator. Mediation, on the other hand, involves a third party that listens to both sides of the argument, but instead of making a decision, they help the parties reach their own fair conclusion. While friendlier in nature, mediation can take considerably longer than arbitration.

Establishes the process for adding or removing a member from the LLC, when members can sell or transfer their shares, what happens if a member dies, and other member-related procedures.

Provides guidance in the event the company is shut down. When a company is dissolved, the remaining assets are distributed, the IRS is notified, a dissolution agreement is completed and signed by all members, and the final taxes are paid.

The following table contains links to each state’s operating agreement statutes or general LLC laws.

| STATE | LAWS |

| Alabama | § 10A-5A-1.08 |

| Alaska | § 10.50.095 |

| Arizona | § 29-3105 |

| Arkansas | Title 4, Chapter 38 | § 4-38-105 |

| California | § 17701.10 |

| Colorado | § 7-80-108 |

| Connecticut | § 34-243d |

| Delaware | Title 6, Ch. 18 |

| Florida | § 605.0105 |

| Georgia | Title 14, Ch. 11 |

| Hawaii | § 428-103 |

| Idaho | § 30-25-105 |

| Illinois | 805 ILCS 180 |

| Indiana | § 23-18-4-4 |

| Iowa | § 489.410 |

| Kansas | § 17-7672 |

| Kentucky | § 275.180 |

| Louisiana | § 1319 |

| Maine | § 1521 |

| Maryland | § 4A-402 |

| Massachusetts | Title XXII, Ch. 156C |

| Michigan | § 450.4308 |

| Minnesota | § 322C.0110 |

| Mississippi | § 79-29-123 |

| Missouri | § 347.081 |

| Montana | § 35-8-109 |

| Nebraska | § 21-110 |

| Nevada | § 86.286 |

| New Hampshire | § 304-C:40 & § 304-C:41 |

| New Jersey | § 42:2C-11 |

| New Mexico | Chapter 15, Article 19 |

| New York | § 417 |

| North Carolina | § 57D-2-30 |

| North Dakota | § 10-32.1-13 |

| Ohio | § 1706.08 & § 1706.081 |

| Oklahoma | § 18-2012.2 |

| Oregon | § 63.057 |

| Pennsylvania | § 8815 |

| Rhode Island | § 7-16-22 |

| South Carolina | § 33-44-103 |

| South Dakota | § 47-34A-103 |

| Tennessee | § 48-206-101 |

| Texas | § 101.052 |

| Utah | § 48-3a-112 |

| Vermont | § 4003 |

| Virginia | § 13.1-1023 |

| Washington | § 25.15.018 |

| West Virginia | § 31B-1-103 |

| Wisconsin | Ch. 183 |

| Wyoming | § 17-29-110 |

Use the links below to look through a state’s database of corporations. It’s useful for finding out if a business name has already been taken by another entity.

| STATE | ENTITY SEARCH |

| Alabama | Business Entity Records |

| Alaska | Search Corporations Database |

| Arizona | Entity Search |

| Arkansas | Business Entity Search Mobile |

| California | Business Search |

| Colorado | Business Database Search |

| Connecticut | Business Records Search |

| Delaware | General Information Name Search |

| Florida | Search Records |

| Georgia | Business Search |

| Hawaii | Search for Businesses |

| Idaho | Business Search |

| Illinois | Corporation/LLC Search |

| Indiana | Business Search |

| Iowa | Business Entities Search |

| Kansas | Business Entity Search Station |

| Kentucky | Business Organization Search |

| Louisiana | Business Filings Search |

| Maine | Corporate Name Search |

| Maryland | Business Entity Search |

| Massachusetts | Search for Business Entity |

| Michigan | Search for Business Entity |

| Minnesota | Search Business Filings |

| Mississippi | Business Search |

| Missouri | Entity Search |

| Montana | Business Search |

| Nebraska | Corporate & Business Search |

| Nevada | Business Search |

| New Hampshire | Business Search |

| New Jersey | Business Entity Name Search |

| New Mexico | Business Search |

| New York | Entity Database |

| North Carolina | Business Search |

| North Dakota | Business Search |

| Ohio | Search by Business Name |

| Oklahoma | Search Corporation Entities |

| Oregon | Business Name Search |

| Pennsylvania | Search Business Entity |

| Rhode Island | Search for an Entity |

| South Carolina | Business Name Search |

| South Dakota | Business Information Search |

| Tennessee | Business Name Availability |

| Texas | Taxable Entity Search |

| Utah | Business Name Search |

| Vermont | Business Search |

| Virginia | Business Entity Search |

| Washington | Corporation Search |

| West Virginia | Business Entity Search |

| Wisconsin | Search Corporate Records |

| Wyoming | Business Filing Search |